Social Security Withholding 2025 Rates - 2025 Max Social Security Tax By Year Usa Patsy Bellanca, For 2025, the social security tax limit is $168,600. Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, That means that the maximum amount of social security tax an employee will pay (through.

2025 Max Social Security Tax By Year Usa Patsy Bellanca, For 2025, the social security tax limit is $168,600.

What Is Max Social Security Withholding 2025 Kate Sarine, The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

2025 Max Social Security Tax By Year Chart Conny Diannne, You file a federal tax return as an individual and your combined income is more than $34,000.

Social Security Limit 2025 Withholding Janey Lisbeth, At the start of 2025, social security benefit rose 3.2%.

Social Security And Medicare Withholding Rates 2025 Berri Guillema, Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time.

Total payments, by state or other area, eligibility category, and age. So, if you earned more than $160,200 this last year, you didn’t have to pay the.

Social Security Withholding 2025 Rates. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The 2025 rate for the social security tax is 6.2% of an employee’s gross earnings up to $168,600 (this limit changes each.

Maximum Social Security Tax Withholding 2025 Tami Lorianne, What is the social security withholding rate for employees in 2025?

Social Security Limit 2025 Withholding Limit Vally Isahella, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

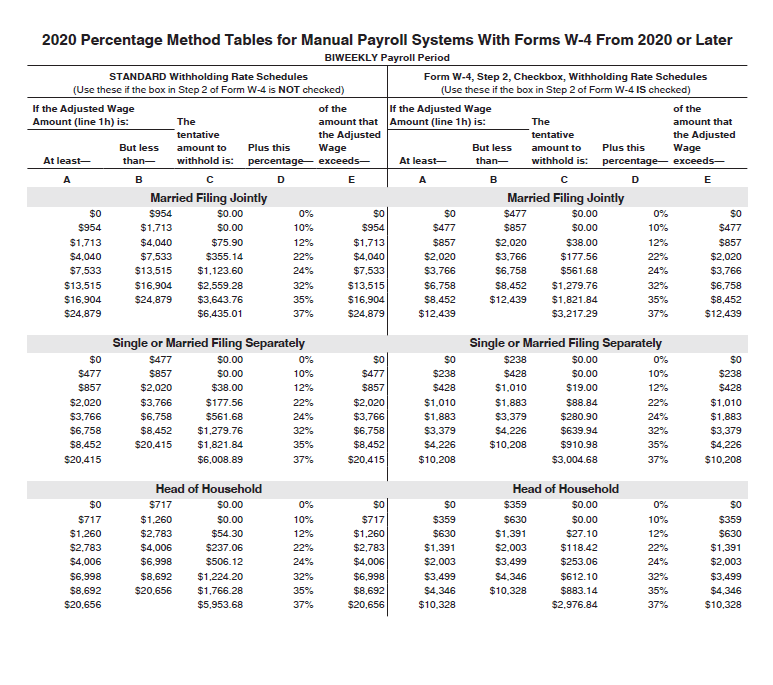

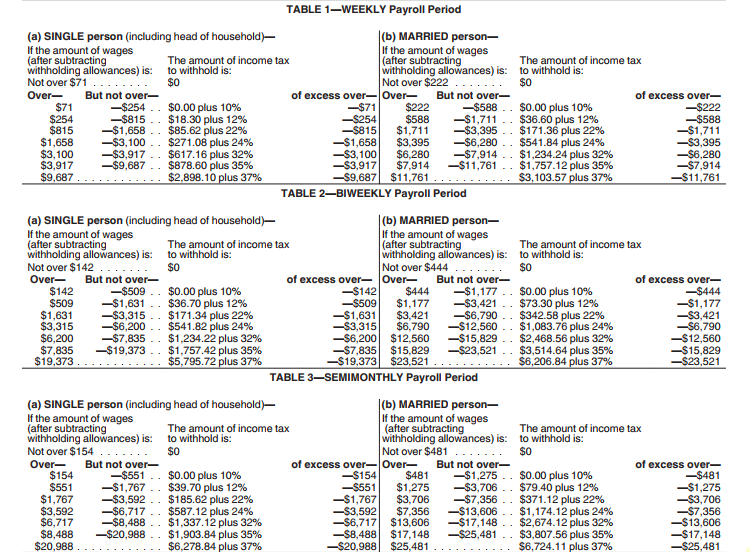

2025 Max Social Security Tax Withholding Table Dode Nadean, The new rules make withholding tax.

Social Security Wage Limit 2025 Percentage Bobby Christa, Average monthly payment, by eligibility category and age.