How Much Is Inheritance Tax In Ca 2025 - California Tax Brackets 2025 Calculator App Elset Horatia, It is critical to note that california does not have an estate tax. Receiving an inheritance often prompts questions about tax liabilities. Inheritance Tax How Much Will Your Children Get? Your Estate Tax, On november 5, 2025, california voters will have the opportunity to vote on the california changes to tax assessment on inherited homes. In california, there is no state inheritance tax, so you can inherit any amount of money or cash without owing state taxes on it.

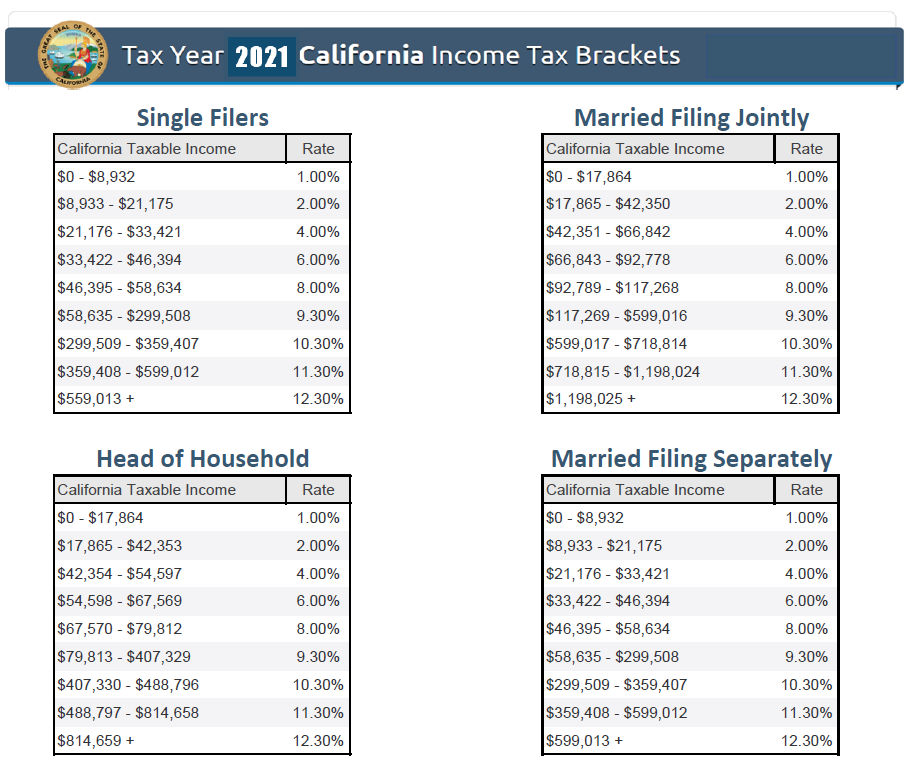

California Tax Brackets 2025 Calculator App Elset Horatia, It is critical to note that california does not have an estate tax. Receiving an inheritance often prompts questions about tax liabilities.

For decedents that die on or after january 1, 2005, there is no longer a.

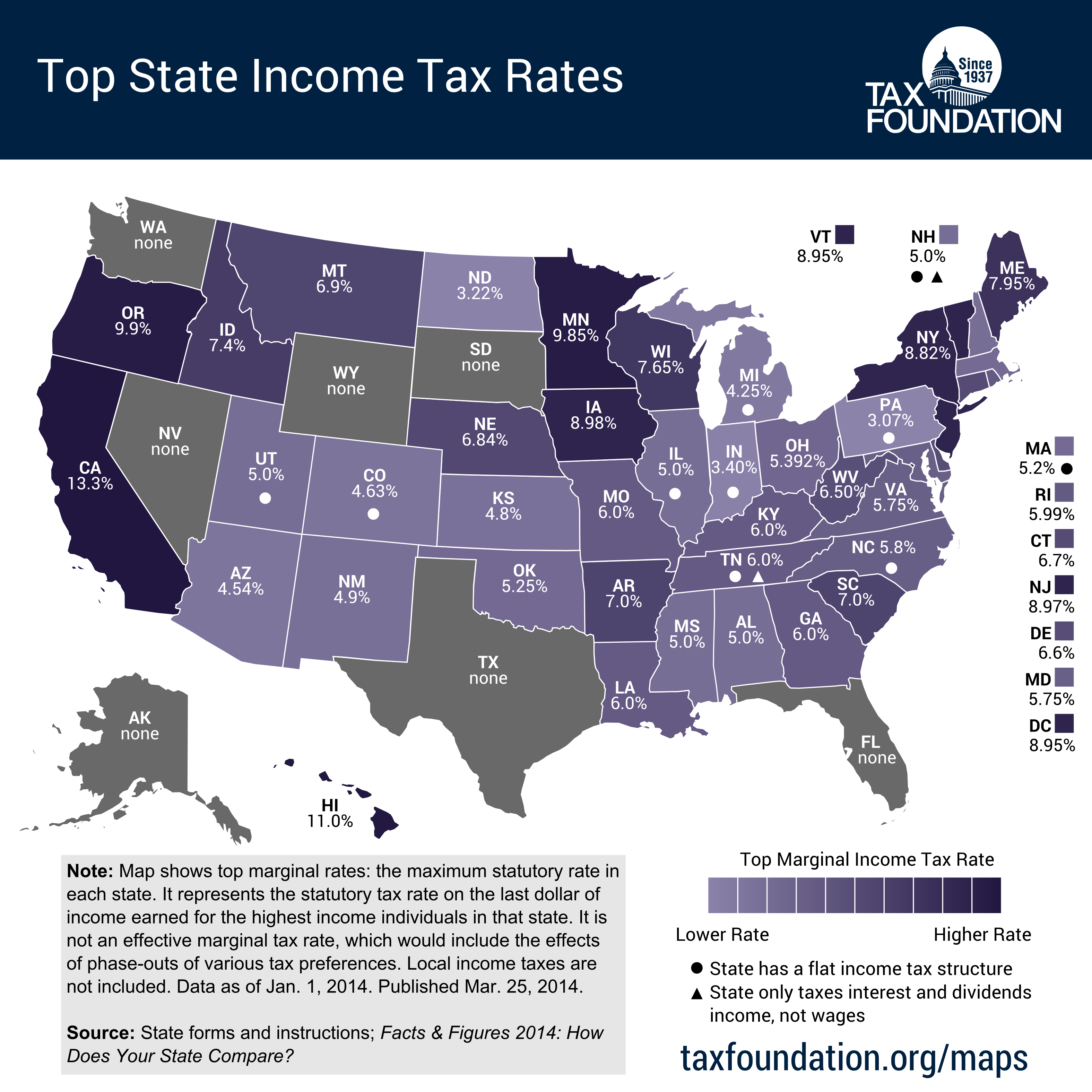

How Much Is Inheritance Tax In Ca 2025. Inheritance tax usually applies when a deceased person lived or owned property in a state with. These rates may be outdated.

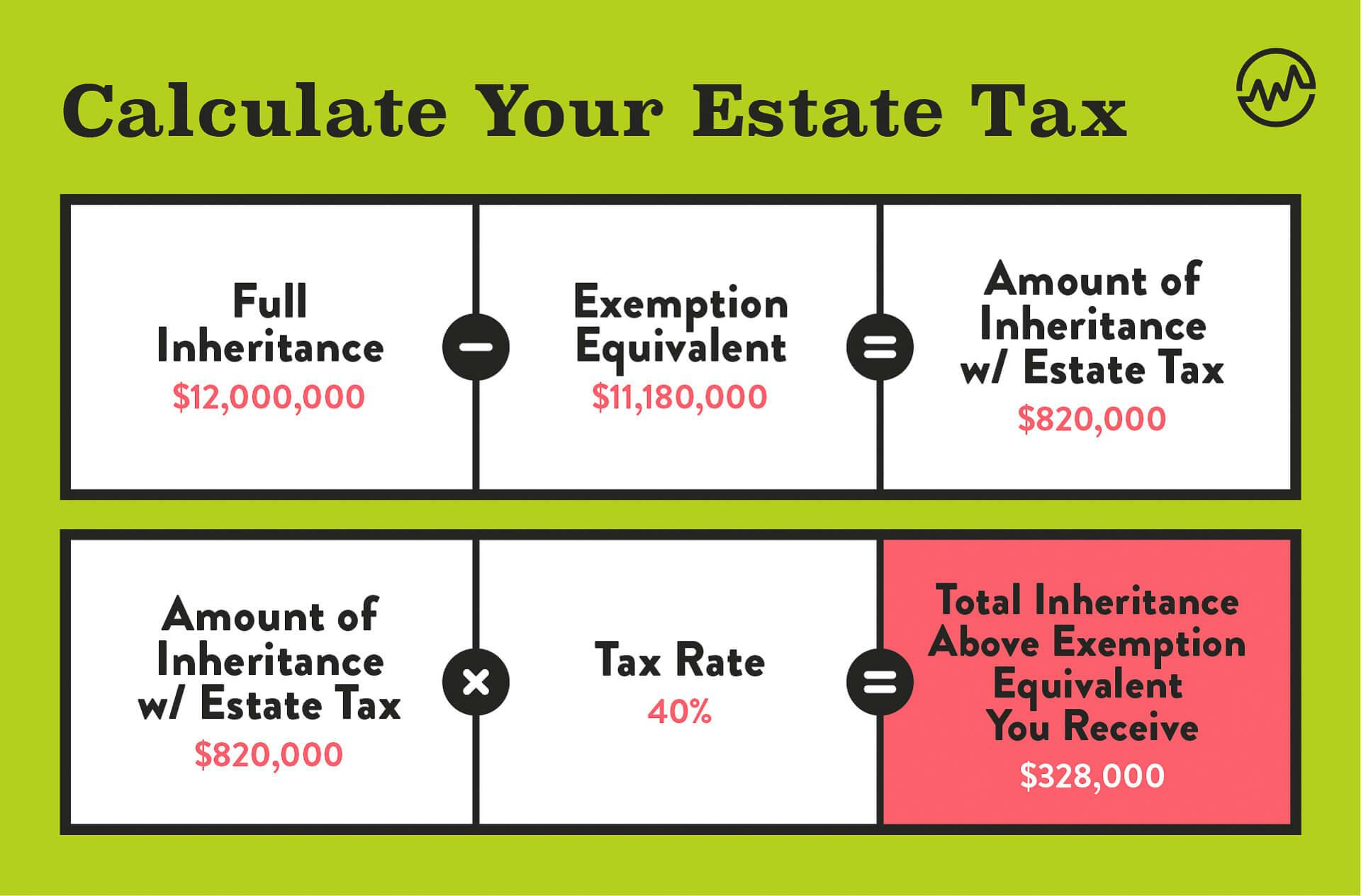

Capital Gains Tax Rate 2025 Donia Jasmine, Free estate tax calculator to estimate federal estate tax in the u.s. Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2025 or $13.61.

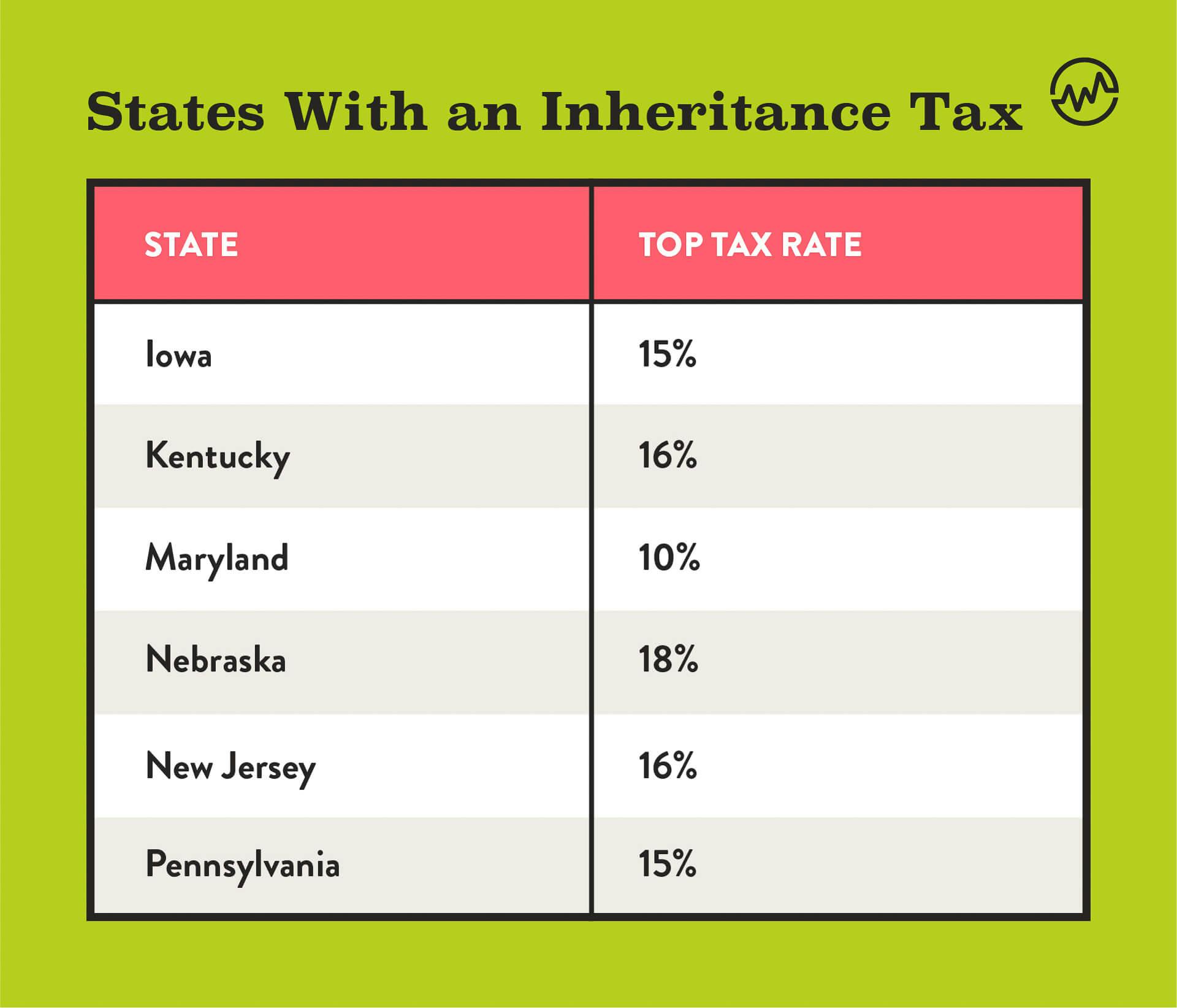

Taxes En California 2025 Albina Tiffie, California does not have an inheritance tax, and. State inheritance tax rates range from 1% up to 16%.

Estate and Inheritance Taxes Urban Institute, Receiving an inheritance often prompts questions about tax liabilities. California city & county sales & use tax rates (effective july 1, 2025) español.

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, In 2025, the estate tax exemption increases to $13.61 million for individuals ($27.22 million for married couples). California does not have an inheritance tax, and.

The exemption amount and the rate assessed often depend on the relationship to the. Federal estate/trust income tax return:

Capital Gains Tax Rate 2025 California Cecily Tiphani, This is up from $12.92 million in 2025. Even though california does not have a state estate tax or inheritance.

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-c5902af4dd0e49918533982c240cf419.jpg)

How Much Is Inheritance Tax 2025 Usa Lenka Nicolea, However, if the gift or inheritance later produces income, you will need to pay tax on that. State inheritance tax rates range from 1% up to 16%.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, No inheritance tax in california for 2025. What this means is that for individuals with estates worth $13.61.

Estate tax applies at the federal level but very few people actually have to pay it.

Is Inheritance Taxable in California? California Trust, Estate, California city & county sales & use tax rates (effective july 1, 2025) español. Even though california does not have a state estate tax or inheritance.

Unlike the federal gift tax which focuses on lifetime transfers, the california inheritance tax primarily targets beneficiaries who receive property through an estate.

If you received a gift or inheritance, do not include it in your income.